The economics of flying routes of over seven hours are different to those of short-haul, and legacy carriers are better able to manage volatile fuel costs. Like Ryanair, Hungarian Wizz Air Holdings says it’s not planning a low-cost, long-haul strategy. "Stripping it down to 25-minute turnarounds or to the basic add-on philosophy is never going to work on long haul," said Ryanair boss Michael O'Leary. Added to this, fuel, where ultralow-cost carriers have no price advantage, makes up a larger portion of costs on a long-haul flight than on a short-haul flight. The carriers struggled because they weren't able to make up for cheap fares by turning aircraft around more frequently than their legacy airline rivals. "The market will be viable only if there is a demand," Peter Knapp, the chairman of Landor & Fitch, a brand consultant, told DW. Ryanair boss Michael O’Leary says his airline is not considering transatlantic flights Is the market ready? However, one area where Norse appears to have learnt from Norwegian's mistakes is in talking with labor associations on both sides of the Atlantic. It also doesn't offer business and first-class cabins. CEO Bjorn Tore Larsen, who holds 15% in the new venture, says the airline has "nothing to do with" Norwegian.īut the airline plans to fly the same aircraft and operate from the same airports and may also hire the same, recently laid-off, staff. Norse Atlantic's 15 aircraft will launch commercial operations on trans-Atlantic routes in December, the company said. Norse Atlantic Airways was set up in February with shares trading on Euronext Growth Oslo since April. The Norwegians are also making a comeback. Another French airline, La Compagnie, has also resumed flying between the US and France, with its first flight on June 12 between Newark and Paris. The company said there was sufficient demand from US tourists and the cargo industry to offer the flights. Low-cost leisure airline French Bee returned to the US on July 15 with a new route between Newark and Paris. Many saw this as the end of the experiment in the budget trans-Atlantic market. The new entrants on the trans-Atlantic market, such as Norwegian, were popular but not profitable and started disappearing, with carrier Primera being the first in October 2018, followed by Wow in March 2019 and Norwegian in March 2020. Norwegian was the biggest discount carrier, offering 40% of those seats. By the third quarter of 2018, LCCs flew 15% of the 13.2 million seats in the trans-Atlantic marketplace, data from the Official Aviation Guide of the Airways (OAG) show. Norwegian Air began flying across the Atlantic in 2014, with roundtrip tickets selling for about $500. US to maintain entry ban on European travelers: DW's Stefan Simons reports Budget carriers beware This allows JetBlue to return to its home market and thus get back into the business," he added. "Conversely, this is currently still denied to EU citizens. "JetBlue can start its flight operations under different conditions than European airlines: Vaccinated, recovered and tested US citizens can enter the EU," Thomas Jachnow, a spokesperson for Lufthansa, told DW. Forbes found that the lowest fare was a $202 Blue Basic ticket from JFK to London on September 8. Hayes says the prices will be far below what rivals charged for business class, starting at less than $2,000 (€1,700) for a round trip from the US.

The airline, one of the biggest in the US, will deploy a single-aisle, narrow-body plane, the Airbus A321LR. Business magazine Forbes reported that JetBlue's inaugural flight had sold out. JetBlue will have 24 seats in business class, known as Mint, which some believe will allow the airline to compete on level terms with existing carriers.

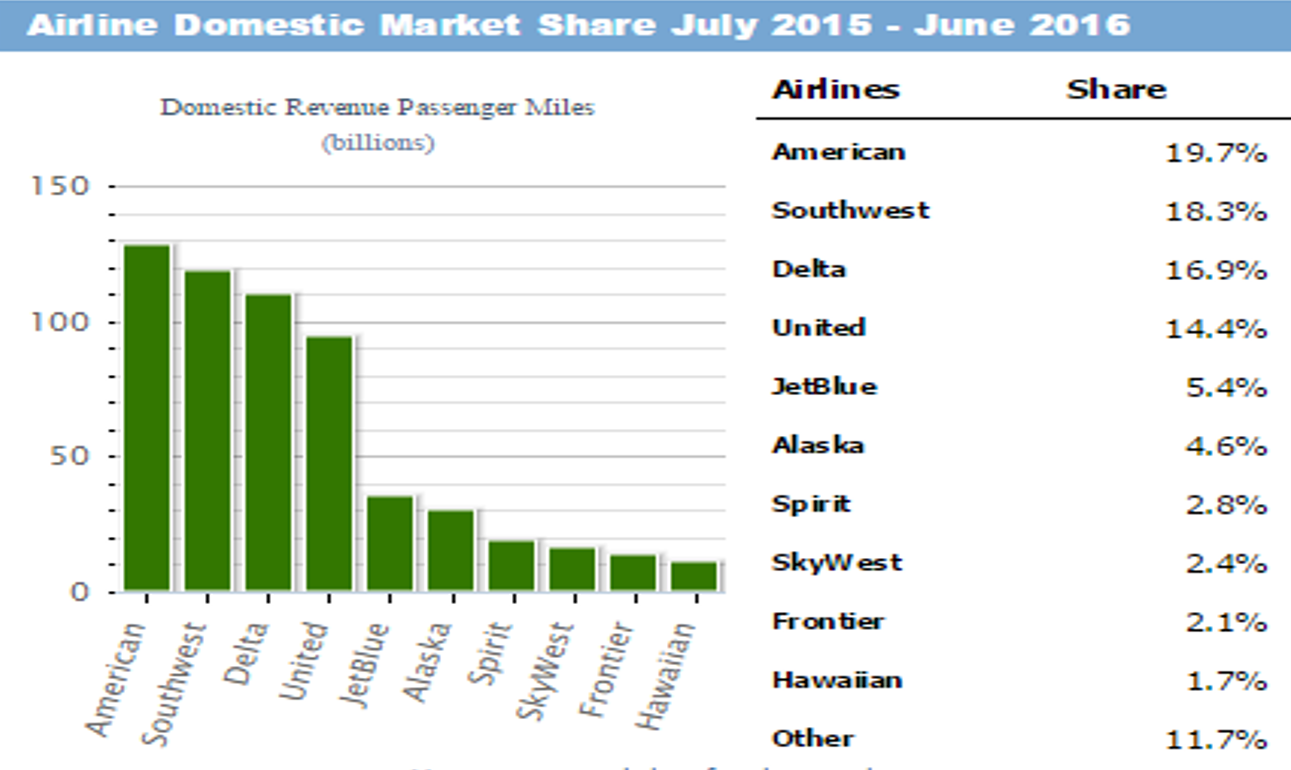

Norwegian had a fleet of Boeing 787 Dreamliners and no business class. The key difference could be a mixed offer with business and economy classes. JetBlue Chief Executive Robin Hayes said his airline was nothing like rival carriers that promised to bring low fares to the trans-Atlantic route and then folded. Virgin Atlantic and British Airways lead by market share on this route, with 38% and 30%, respectively. JetBlue wants to cash in on the busiest city pairing in the world - New York/London - where competition was already fierce before the pandemic. Pre-pandemic, low-cost carriers secured 15% of the trans-Atlantic market, with Norwegian offering 40% of all seats JetBlue: Fight or flight?

0 kommentar(er)

0 kommentar(er)